When Bitcoin, the world’s first cryptocurrency, came to the marketplace in 2009 at $0.0009 per coin, most of us in the financial services world thought of it as an odd concept at best and a scam at worst. Jamie Dimon, one of the great minds on Wall Street, thought of Bitcoin as a Ponzi scheme.

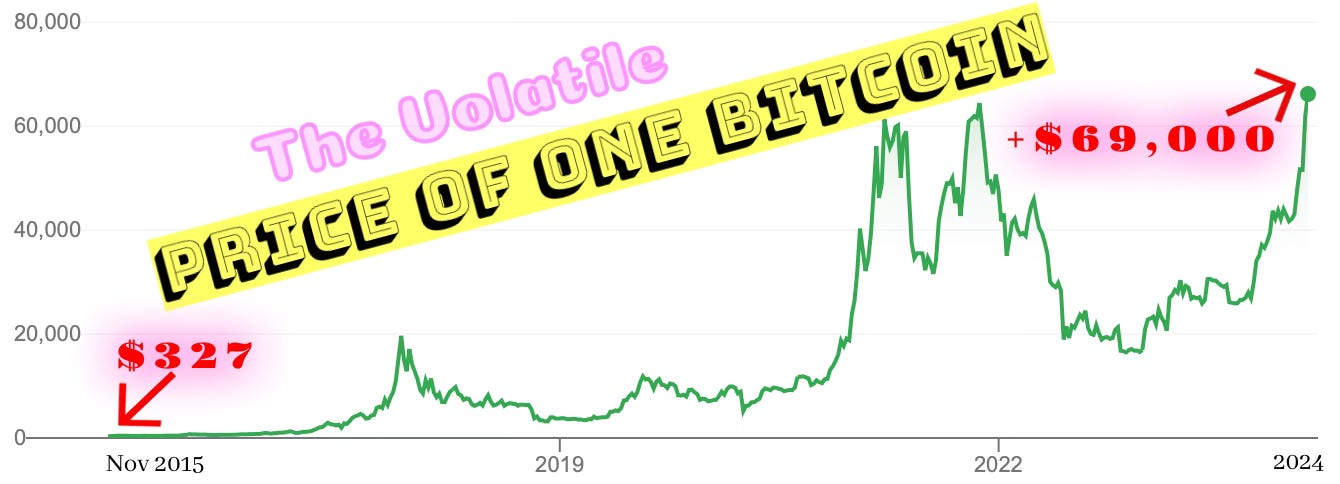

Here we are, 15 years later, and Bitcoin, the best known, as well as many other cryptocurrencies, are as prominent as ever! The price swings have been dramatic. Millions have been made and millions have been lost. Bitcoin has just traded for over $70,000 per coin. Imagine if you were the first trader of Bitcoin, (5,050 coins for just over $5), today that trade would be worth over $300 million!

Prominent politicians, such as Miami Mayor Francis Suarez and well-known athletes such as Odell Beckham, Jr. receive their salaries in Bitcoin.

A cryptocurrency is an algorithm. “Cryptos” are any form of currency that exist digitally or virtually and use cryptography to secure transactions.

Cryptocurrencies do not have a central-issuing or regulating authority. They instead use a decentralized system of recorded transactions and issue new units. It’s a digital payment system that doesn’t rely on banks to verify transactions.

Welcome to the World of Blockchain

Instead of being physical money carried around and exchanged in the real world, cryptocurrency payments exist purely as digital entries to an online database for specific transactions.

Almost all cryptocurrencies use a decentralized, distributed ledger technology known as “blockchain.” This enables secure recording of transactions across a network of computers. It operates as a series of linked data blocks, where each block contains a record of transactions. These blocks are connected in a chronological and immutable chain, hence the name “blockchain.”

Cryptocurrency received its name because it uses encryption to verify transactions. The aim of encryption is to provide security.

While many choose to hold onto their digital assets for the long term, others are enticed by the potential quick profits offered by short-term crypto trading. Much of the interest in cryptocurrencies is to trade for profit, with speculators at times driving prices skyward.

Short-term trading allows investors to capitalize on price volatility within the crypto market. Traders aim to exploit price fluctuations, profiting from both upward and downward movements. By leveraging technical analysis and market trends, skilled traders can identify short-term opportunities and potentially generate significant returns.

Cryptocurrency markets operate 24/7, providing traders with ample liquidity for executing trades. Unlike traditional financial markets with limited trading hours, the crypto market’s constant availability enables traders to enter and exit positions quickly.

Shot-term crypto trading may allow investors to diversify their portfolios beyond traditional assets. Cryptocurrencies also have a low correlation with traditional financial markets.

Cryptocurrencies are notorious for their price swings, which can result in substantial gains or equally significant losses within short timeframes. The unpredictable nature of the market exposes traders to heightened risk, making it crucial to employ robust risk management strategies and set stop-loss orders to limit potential losses.

Fear and greed often drive short-term trading, which can cloud judgment and result in poor trading outcomes. Maintaining discipline and a rational mindset is paramount for successful short-term trading.

Frequent buying and selling leads to increased transaction costs. Crypto exchanges charge fees for every trade executed, which can eat into profits, especially for high-frequency traders. Additionally, tax implications vary across jurisdictions, and short-term trading may bring higher tax liabilities due to the increased frequency of trades.

Crypto Goes Mainstream

Recently the cryptocurrency market has evolved rapidly, expanding into mainstream finance. One significant development within this evolution is the emergence of cryptocurrency exchange-traded funds (ETFs). These financial instruments have been given considerable attention as they offer investors a regulated and convenient way to gain exposure to the crypto market without directly holding cryptocurrencies themselves.

ETFs are investment funds that are traded on stock exchanges, much like individual stocks. They typically hold assets such as stocks, bonds, commodities, or, in the case of crypto ETFs, cryptocurrencies. Crypto ETFs allow investors to buy and sell shares that represent ownership in a diversified portfolio of cryptocurrencies. This structure enables investors to gain exposure to the crypto market without the hassle of managing digital wallets or dealing with the security risks associated with holding cryptocurrencies directly.

By investing in a crypto ETF, investors gain exposure to a diversified portfolio of cryptocurrencies, reducing the risk associated with investing in any single digital asset. ETFs are traded on stock exchanges, providing investors with liquidity and the ability to buy or sell shares at prevailing market prices.

Crypto ETFs are regulated financial products, providing investors with a level of oversight and protection that is lacking in many other forms of cryptocurrency investments.

Cryptocurrency, an investment that seemed silly in 2009, has developed into an important part of the current investment marketplace. Many of the top economists believed that cryptocurrencies would never become a major part of the world’s investment arena. They were wrong.

Investors in cryptocurrencies must consider the risks and look at taking a prudent approach while continuing to follow their financial plan.

And remember: “Stay the course!”

At one point, I owned one Bitcoin that I purchased for approximately $3000. I sure wish I hadn’t panicked and held onto it.

Interesting brief history of Bitcoin, the security of decentralized blockchain tech, as well as potential investment opportunities for crypto coins...I do believe that cryptos will play an important role as we transition to new currencies to replace to the almost dead US Petrodollar - its prominence continues to decline as it makes its way to humanity's trash pile...much of the turmoil occurring across the world today is due to the death of the US dollar, as created by the US federal reserve in 1913...

FACT: US Federal Reserve Bank is a privately-owned company, sitting on its very own patch of land, immune to the US laws...history has shown that currencies have an average lifespan of about 70 years, the US dollar is now over 110 years in age and is nearly exhausted...

another phenomenon that came upon the scene about the same time as Bitcoin is the BRICS intergovernmental organization (initially comprising Brazil, Russia, India, China, and South Africa)...BRICS membership has grown since then and is now rapidly expanding — about 30% of the world's land surface and 45% of the global population are now within BRICS...importantly, all of the OPEC states are members or set to join BRICS...

the writing is on the walls, the US Dollar is dead...smart money is moving to gold & silver in order to survive the impending financial collapse...central banks across the world are gobbling up gold (see last 2-3 years, since BIS required as Tier 1 asset)...good time to consider altering course in order to protect the nest eggs...gold, silver, and cryptos, may provide the life raft needed to survive The Storm...