The City of Santa Barbara is facing a significant $7.1 million deficit and is now requesting another increase in our sales tax (Measure I) to address this financial shortfall.

This situation raises concerns about the city's reliance on tax hikes to manage its budgetary issues.

Previously, I highlighted Measure C, which involved a one-cent increase in sales tax aimed at funding infrastructure projects. The expenditure report indicated that funds were allocated to various departments, including the Fire Department, Library, and Parks. I argued that the proposed half-cent increase is primarily intended to cover pension and retirement obligations, and I submitted a Public Records Act Request for the last five years of California Public Employees Retirement System (CALPERS) invoices.

I received my PRAR (Public Records Act Request) response and noticed there are multiple Plan Identifiers, so I will just show you Plan Identifier 181.

Invoice #16849946

Total: $18,582,644.

Or a monthly payment of $1,601,836.

The difference between the total outstanding amount and the monthly payment due adds an additional financing cost of $639,388 per year. This is like paying for our city’s pensions on a high-balance credit card. Deeper and deeper the massive unfunded pension hole grows.

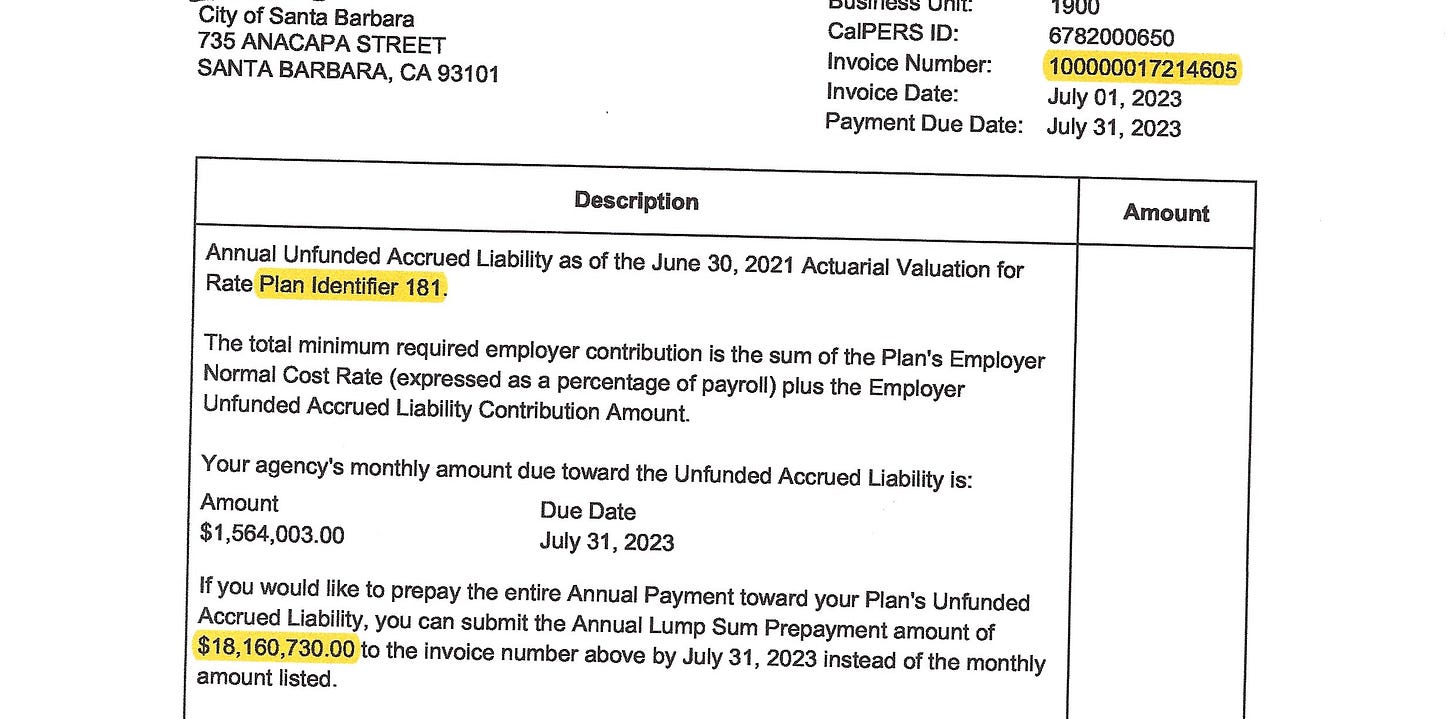

Invoice #17214605

Total: $18,160,730. Or a monthly payment of $1,564,003. Totally $18,768,036. Which is an additional annual financial cost of $607,306.

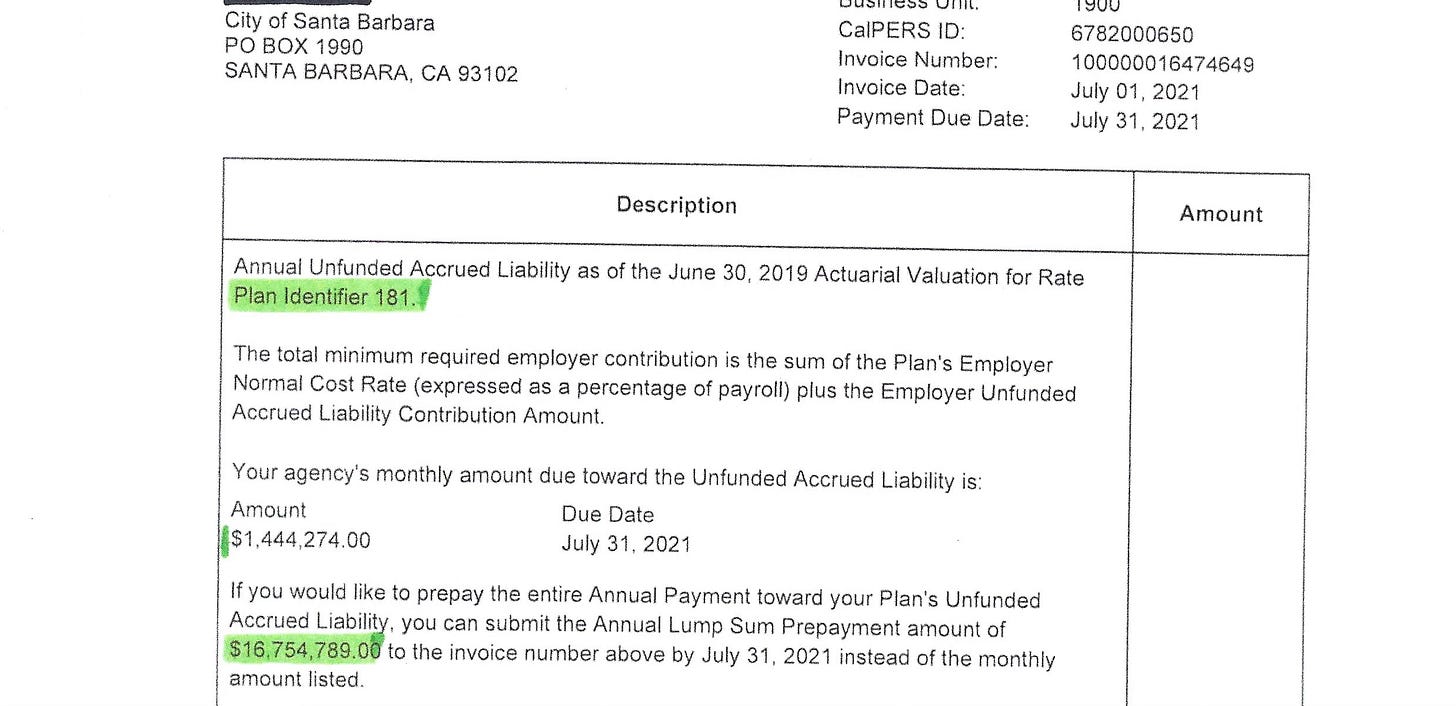

Invoice #16474649

Total: $16,754,789. For the year or a monthly payment of $1,444,274. At 12 months Total $17,331,288. Which would mean an extra annual financing cost of $576,499.

City of Santa Barbara Media Release

On June 11, 2024, the City Council voted unanimously to place the Santa Barbara Essential Local Services Measure (Measure I) on the November 5, 2024, ballot. If approved by Santa Barbara voters, the measure will generate an estimated $15.6 million annually to support the City’s General Fund, which pays for local services, including public safety, maintenance, libraries, affordable housing, and more.

As I anticipated, the projected revenue from the new tax, estimated at $15.6 million, corresponds to the total amount owed in a single year's CALPERS Plan Identified invoice (there are multiple). This raises questions about the sustainability of relying on tax increases to address ongoing financial commitments rather than implementing more comprehensive fiscal reforms.

Such as reducing the City’s workforce!

The Santa Barbara Essential Local Services Measure was placed on the ballot after a series of more than 20 community meetings, including six public town halls, between October 2023 and May 2024. At these meetings, staff discussed the status of the City’s services, budget, and the potential for new revenue to support them. A community survey found that a majority of respondents rated the following areas as high priority: maintaining 911 emergency fire, paramedic, and police response; improving housing affordability; preventing thefts and property crime; addressing homelessness; and keeping public areas safe and clean.

These services and others are supported by the City’s General Fund. Current forecasts suggest that the General Fund could see deficits of as much as 5-to-7% ($11 million to $15 million) within the next three years, despite several years of budget “reductions” across City departments.

During the June 4th council meeting, Finance Director Keith DeMartini stated, “Our charge was set out to develop a list of all the ways we could generate additional revenue as an organization. We really left no stone unturned.” He later added, “Sales Tax would generate the most revenue annually,” and “it’s also really important to note that nearly half of all the sales tax dollars that are generated do come from tourists.”

The Santa Barbara Essential Local Services Measure ballot question reads: “Shall the measure maintaining 9-1-1 emergency/fire/paramedic/police response, keeping neighborhood fire stations open; improving housing affordability; addressing homelessness; keeping public areas/parks safe, clean; maintaining library services, stormwater protection; improving natural disaster preparedness; retaining local businesses/jobs, and for general government use; by establishing a ½¢ sales tax providing approximately $15,600,000 annually until ended by voters; requiring audits, public spending disclosure, all funds used locally, be adopted?”

The measure would add a ½ cent tax to applicable purchases in Santa Barbara and includes “accountability” provisions, including public disclosure of all spending, and annual independent financial audits. The proposed tax increase would be collected in the same manner as the existing City sales and use tax and would be subject to all the same tax exemptions, such as services, rent, groceries, prescription medicine, utilities, diapers, and feminine hygiene products. For a complete list of all the sales and use tax exemptions, please visit the California Tax Service Center.

Legally, funds generated by the Santa Barbara Essential Local Services Measure cannot be taken by the State government or transferred to any other agency. The measure requires a majority approval of Santa Barbara City voters this November 2024.

More information about the Santa Barbara Essential Local Services Measure can be found at SantaBarbaraCA.gov/Nov2024Ballot.

How much do you want to bet that all UNIONS will be endorsing Measure I?

To show you how seriously City Council and City Staff consider this deficit, Please watch City Council on Tuesday, September 17th beginning at 2 PM on Channel 18 or on your computer.

And come this November, whatever you do, VOTE NO on Measure I. Stop the insanity.

Now on to State Street and the allocation of even more money to it.

SB City Council Agenda Item 9:

COMMUNITY DEVELOPMENT DEPARTMENT

9. Subject: State Street Master Plan Vision and Short-Term Action Plan (650.05)

Recommendation: That Council:

A. Receive a progress report for the State Street “Create State” Master Plan and provide direction on the recommended Grand Paseo design framework; and

B. Receive an update on a Short-Term Action Plan for the State Street Master Plan project area.

The City Staff will discuss 300-1300 State Street and suggest spending more for temporary fixes and master plan. Enough is Enough! Incidentally, Mayor Rowse will most likely be the only NO Vote on Agenda Item 9. The fix is easy: Open State Street

Remember the PRAR a few years ago, at that point, they had spent over 3 Million Dollars on the Pedestrian Promenade!

And you ask what can you do?

Call or write to the City Council.

Mayor & Council Offices

City Hall

Holly Perea, Executive Assistant

(805) 564-5318

HPerea@SantaBarbaraCA.gov

In the SUBJECT line write PLEASE deliver to City Council

Help this great group, Kids Draw!

Yesterday was the deadline to be a sponsor but I think they might take you if you submit it today.

Great work as usual Bonnie, very informative. Sounds like the city is drowning in red ink. The city deficit is one thing, but when you add unfunded pension liabilities of the County of $1 Billion and the State $1 Trillion it adds an extra sense of urgency. Also, adding sales tax is again one thing, but the issue of repealing Prop 13 is of even more concern and if some activists have their way, will become reality. If Prop 13 is ever repealed, it’s game over for California and will be the final nail in the coffin.

I fear the pension doomsday scenario is just beginning and is a ticking time bomb waiting to go off on the taxpayers.

The root cause? I think we all know, it’s been from years of mismanagement by the one party state at managing costs, and colluding with the public sector unions. Both resulting in unrealistic city wages and pensions. When a city pension is more than what the employee would normally make, or in excess of $200-$300k annually, you know you’re in trouble. Further, when negotiations happen between the unions and city government, both parties are seemingly to be on the same side of the bargaining table…surprise!

As pension cost rises as does servicing the debt, levels of service (LOS) decreases. There is a tipping point when the cost of pensions are the single highest line item in the budget. How close are we?

I think a change to a defined contribution plan from a defined benefit plan would help resolve some of the under funded issues.