A little more than forty years ago, in 1982, there were 298,694 residents in Santa Barbara county compared to today’s population of 448,229. While our population grew 50% since 1982, the county budget grew by 1,000%.

How could this be?

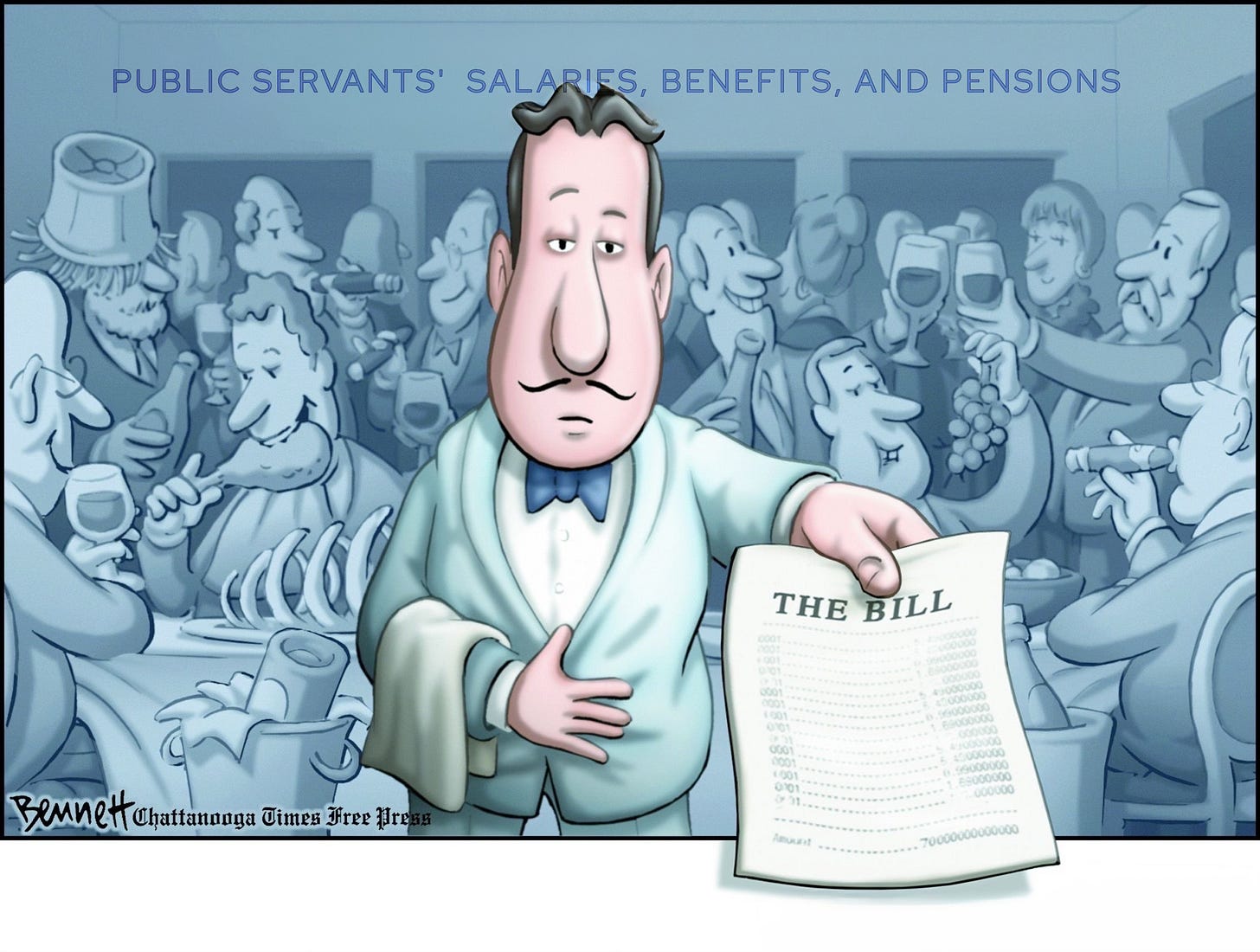

It all has to do with obscene growth in government salaries, benefits, and pensions.

In 1982, per capita income in the county was $59,649. Today, it is $75,720, an increase of only 26% over 40 years. Meanwhile, county government costs grew from $475 per year per citizen to $3,391 per year per citizen, a 613% increase.

The average wage of a Santa Barbara County employee is now $100,000 per year, which is 32% higher than the private sector. Scores of people working in government earn upwards of $200,000 or more per year. Santa Barbara County’s employee retirement plan pays out over $184 million per year. Soon, dozens of former employees will be receiving more than $200,000 for the rest of their lives.

Meanwhile, the infrastructure debt in our county exceeds $400,000,000.

Defined Contribution vs. Defined Benefit

These wages are the foundation of the pension (and budget) crisis that has engulfed California. Private citizens can earn a Social Security benefit that earns a maximum of some $5,000 a month, if they work until they are 70 years old. Some private-sector workers may additionally have a 401k or IRA savings plan, but the amount that can be invested in these accounts is limited by government. Nonetheless, the vast number of Americans have nothing to sustain them in their retirement except Social Security and perhaps the value of their house, if they sell it or borrow against it.

Unfortunately for taxpayers and the budgets of our local and state government, there is virtually no limit to how much can be earned with a government pension plan. The big difference between a private citizen’s retirement earnings and that of the public sector is this: However much money is earned in a private citizen’s account is what they get. That is, the private citizen only gets what his investment is worth at the time he or she retires. That is called a defined contribution plan, the value of which is only determined by the contributions to the plan and how well the plan did on its investments.

Public sector retirement plans are completely different. Career employees earn a percentage of their highest salary for the rest of their lives, even when the payout far exceeds what was originally invested on behalf of the employee. That is because the retirees don’t earn a pension based on their average earnings over the years. Instead, their pension is based on their highest final average salary. In many cases, the highest paid pensioners will receive more money in retirement than they earned during their careers. Moreover, even if the investment lost money, the benefit is fixed based on the years of public service and the final highest salary earned, with the difference being made by taxpayers. This is called a defined benefit plan.

Consequently, the estimated pension debt for all government pension plans combined in the state of California exceeds $1 trillion.

A Millionaire’s Retirement Plan

We used to define a public servant as a person who was employed to serve the public. That description is now extinct. Public servants have now become people who are served by the public. That is, in the old days, the concept of a civil servant was somebody who, like our men and women in uniform, accepted a low-paying job as a means of serving their community. Well, those days are long gone. At least, they are long gone for public servants. Whereas some of our military families still qualify for welfare because they are paid such a pittance (as little as $10-12 per hour), many public sector workers are retiring like millionaires.

The website "Transparent California" needs to be on everyone's bookmarks. Using this website helps tax payers better understand what every government employee is paid since the sole government employee funding source is our own tax dollars. Learn what is the total compensation package cost to tax payers, not just the government employee's take-home "salary". The total cost to tax payers includes all taxpayer-funded health benefits and pension contributions for our government employees.

We are witnessing right now the public employee union bargaining process with the Santa Barbara Unified School District (SBUSD), punctuated by organized marches and lawn signs. This bargaining takes place between the local teachers unions and the elected school board members, who are often elected through generous support from those very same school district union members themselves. It would be hard to describe this as an independent arms-length bargaining process.

When teacher union members actively support school board candidates, the teachers unions essentially now sit on both sides of the bargaining table spending "other people's money". What do you think the final outcome will be? Join in this process and become a very interested observer, since as taxpayers we are all directly affected by both the ever declining-quality of the final product, and the ever-growing costs of production.

Take time to review Transparent California to learn what Santa Barbara Unified School District teachers are making in Santa Barbara, their total compensation packages for their 9- month year. Administrators typically work a 12 month year, compared to the teachers 9-month year when comparisons in total compensation between the two are made.

Learn how voters passed Prop 98 to generously protect public education, after the passage of Prop 13 property tax protection. Then determine in a declining state budget, where will the currently demanded extra compensation money actually come from? Which specific Peter will need to be robbed to pay Paul.

Look beyond the coy bumper sticker sentiments and get serious about both the source of dollars available to support public education, and not just the one loudest voice currently heard from only the self-interested local teachers unions.

With so much of our tax dollars, paying for the defined Contribution plans there’s a little left over to maintain the counties infrastructure or to deal with the social issues such as homelessness. I have a friend who retired from Santa Barbara County 18 years ago and is collecting over 200,000 a year. His union was able to jack up his last year‘s salary so that his pension is far more than what he earned while he was working for the county.

There are so many important projects that we need to deal with in the county as our infrastructure deteriorates, and as we see more and more homeless people wandering the streets, screaming obscenities. Those people need help. Not the county employees that are living off of some screwed up retirement plan. So the next time you drive down town and see some poor old lady pushing a shopping cart full of plastic bags remember the county employees that put her there. And not just county employees but they’re labor union .