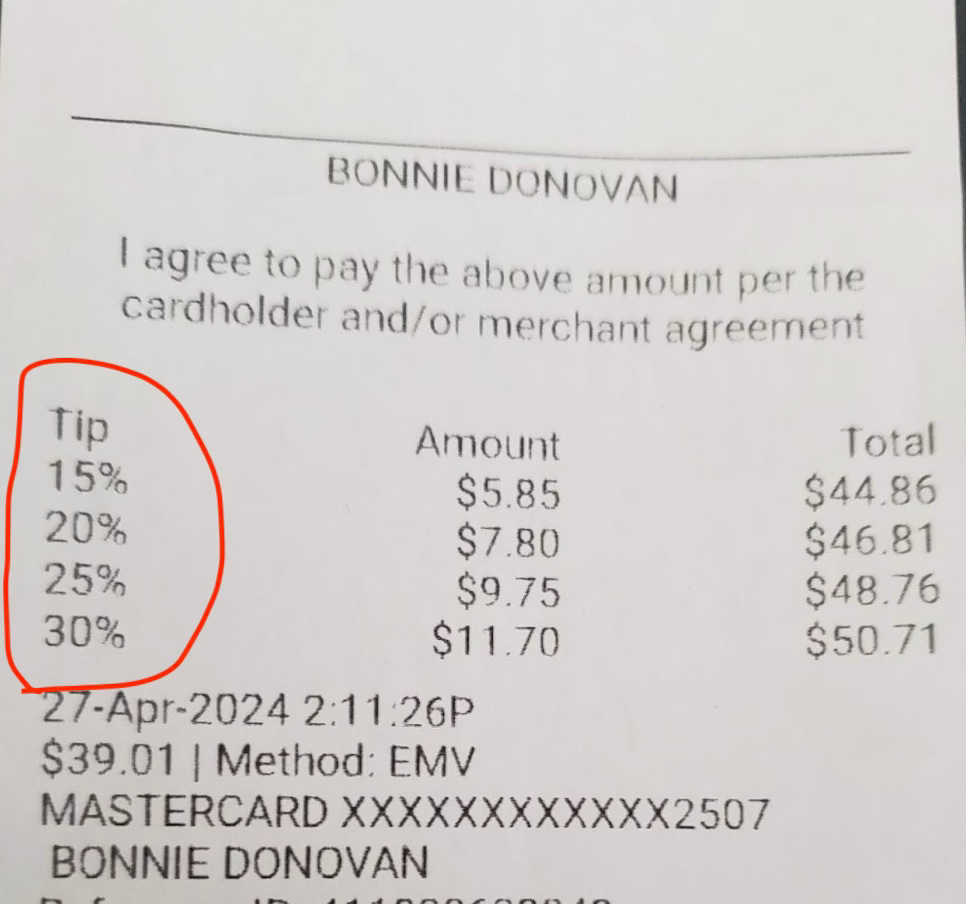

The surge in prices over the past four years has had a profound impact on various sectors, leading to a significant shift in consumer behavior. This prevailing scenario has prompted individuals from all walks of life to recognize the potential for maximizing their profits. One industry that has been particularly affected is the service industry, where an unexpected development has left many astonished. The receipt presented below serves as a striking illustration of this phenomenon, as it showcases the growing expectation among wait staff to receive a substantial 30% tip from their customers. This sudden demand for higher gratuities has caught many off guard, highlighting the far-reaching consequences of rising prices on our daily lives.

Remember when tips were 10%?

They want me to pay $50.71 for flautas and a margarita?

Higher Prices, More Taxes Requested

The impact of increased prices is not limited to the service industry. It has permeated various aspects of our lives, influencing our purchasing decisions and financial planning. From groceries to housing, the cost of living has witnessed a significant surge, forcing individuals to adapt and find ways to cope with the changing economic landscape.

The prevailing scenario in the market reveals a notable surge in prices, prompting individuals from all walks of life to seize the opportunity and capitalize on the situation.

This has led to a surge in people trying to maximize their profits. Entrepreneurs and business owners are constantly seeking innovative strategies to offset the rising costs and maintain profitability. Consumers, on the other hand, are faced with the challenge of balancing their budgets and making informed choices in a market where prices continue to rise.

Before these past 4-year price increases, our city faced financial challenges in maintaining its infrastructure; as a result, a bailout or financial assistance was required to address the issue, so the city proposed a 1-cent increase on sales tax. It is natural to wonder whether this tax increase has led to noticeable improvements in our city from this additional tax.

Have you observed any positive changes or improvements in our town as a result of that increased tax?

Moving forward, the City Council has now proposed an additional ½-cent increase on all purchases. This proposal was voted on during the City Council meeting held on Tuesday, June 11, 2024; it is scheduled to be included on the ballot for the November 5, 2024 election. It is important to consider the potential impact of this tax increase on our daily lives and the overall economy

SECTION 1. The City Council finds and determines as follows:

A. The City provides general municipal services and facilities, such as police, fire, parks and recreation, streets, bridges, stormwater protection, libraries, youth and senior programs, a local housing trust fund, homeless services, and other general fund services that are vital to the health, safety, and general welfare of the people of Santa Barbara.

B. The City's revenues are insufficient to fully provide general municipal services and facilities, including maintaining 9-1-1 emergency fire, paramedic, and police response, keeping neighborhood fire stations open, improving housing affordability, addressing homelessness, keeping public areas and parks safe and clean, maintaining library services, stormwater protection, improving natural disaster preparedness, retaining local businesses and jobs, and other general governmental uses at the level that is necessary or desirable at the level that is necessary or desirable. The full report is here.

During the same meeting, the City Council also approved the city budget for the upcoming fiscal year, which unfortunately includes a deficit.

Is Santa Barbara nearing bankruptcy?

Considering the situation, it raises the question of whether the City Council could explore alternative approaches that have proven successful in the past. For instance, they managed to improve the management/finances of the Municipal Golf Course by outsourcing it to a private contractor. Perhaps they could apply a similar strategy to other departments within the city, which could potentially eliminate the need for another tax increase. It would be beneficial to evaluate the feasibility of such an approach and consider its potential benefits for the city's financial stability.

Why is the City in the hole?

It continues removing properties from property tax rolls (another 5 million to Housing Authority at the same above CC meeting Tuesday);

It doesn’t collect sales tax from street vendors, taco trucks, or B-Cycle;

B-cycle still doesn’t pay rent to be on our sidewalks or streets all over the city.

How many more taxes can we handle?

Let's not forget that SBCC will be seeking another bond on property tax, which will ultimately be passed on to tenants. If we vote in favor of these tax increases, we shouldn't complain about the rising rental costs. It's crucial to consider the long-term consequences of our decisions and how they will affect the affordability of housing for everyone.

It's crucial for the City Council to reevaluate its approach and consider alternative strategies to ensure that the best interests of the taxpayers are being served.

Salud Asleep at the Wheel

Santa Barbara’s U.S. Representative in Congress, Salud Carbajal, on the other hand, has taken a different approach. He has a newsletter in which he shares updates on his efforts to support President Biden's border work. However, it's important to reflect on the past three-and-a-half years and question where Salud was during that time. While around 10 to 11 million undocumented individuals poured into our country, Salud never actively addressed the issue.

The link provided leads to a document on carbajal.house.gov, which highlights Salud's stance on immigration. It's worth noting that this document does not address the concerns raised about his previous inaction. It is crucial to have a bipartisan approach when it comes to addressing immigration issues. It is only through collaboration and cooperation between different parties that we can find effective and sustainable solutions. Therefore, it is important to question whether Salud's recent efforts are truly bipartisan or if they are merely politically motivated.

Showing Respect for the American Flag

During a windstorm that occurred in May, a flagpole situated at a local business succumbed to the strong gusts, causing the American Flag to fall to the ground. I decided to retrieve the fallen flag, only to be approached by an individual from the Rescue Mission who claimed to work at this business. This person expressed his intention to take the flag. I pointed out that it needed to be properly disposed of by burning it, as per flag etiquette. I assured him that I intended to handle the matter and replace it with a new flag. However, he dismissed my suggestion, stating that it was “just a flag,” and they “don’t do that.”

Understanding the significance and symbolism behind the American Flag, I decided to contact the company the following day to address the issue. The response from the company was truly remarkable. They not only acknowledged the incident but also took immediate action to rectify the situation. This demonstrates their commitment to upholding the values and respect associated with the American Flag.

In conclusion, I would like to express my gratitude to the manager for handling the situation with utmost seriousness and ensuring that the employee's actions did not reflect the company's beliefs and values.

The following day, I took it upon myself to contact the company to address the situation. To my relief, the company responded promptly and took the matter seriously. They not only rectified the situation by replacing the fallen flag with a new one, but they also added a new one honoring Military, Police and Fire. They also made it clear that the actions of the employee did not align with the company's values and beliefs.

It was reassuring to know that the company was committed to upholding the proper treatment and respect for the American Flag.

SB Current is a reader-supported publication. If you enjoy receiving our mix of daily features please consider upgrading to a paid subscription.

If you’d rather not tie yourself to a monthly or yearly contribution, a one-time donation would work too.

Whatever you choose, your encouragement and patronage is greatly appreciated.

This issue of inflation is not a small item and annoyance.

At a 5% bank CD you are losing approximately 20% buying power on each dollar you have. The wages and expenses tends to be "baked" into the economy. It inflation decreased to 2% you still have a destroyed buying power. How to get back the dollar strength? (here it comes) Deflation. Yep lower the price of goods and services, property, and WAGES.

Then there is the STOP government wage increases and tell civil servants the taxpayers demand a 2% roll back in wages. You know tell them we are not going to pay retirement and benefits the equivalent of millionaires of 20 years ago.

Watch Sacramento go nuts with the above. But then again they would face voter rebellion if the taxpayers voted with their wallets instead of ego and ideology.

Good article..... anyone notice the unnecessary and expensive curb work on outer State St.?????

Thanks Bonnie for this stimulating article!

1. The “Tip” choice concept came about around post Pandemic. I believe it caught many us us (consumers) off guard! Even when picking up “food to go”, we are confronted with a tip? Now, comes the question regarding that tip! Does each business honor the tip given or does a portion of the tip become additional profit?

2. Every “Business”, if you consider Government Business, has a “Pie”. The Pie is divided up into categories of expense. Every example of Business varies depending upon the mandates placed on that business. In Retail, if Labor exceeds 20%, the retailer might fail!

Government has so many mandates that most believe that they need staffing to manage the overwhelming tasks of compliance. Even so, most often when any project is contemplated, a “Study” is ordered at great expense for determination.

Another vulnerability of Government is Suit. Anyone or group has the right to sue over what they consider controversial, expensive!

Lastly, even during Economic Downturns, Government Employees enjoy giving themselves either raises or benefits or both.