Santa Barbarians Voting Themselves Into Poverty

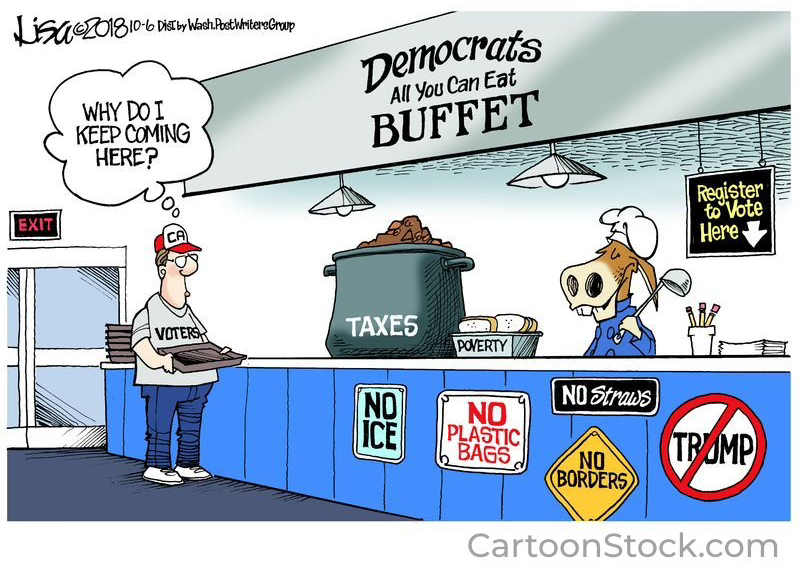

I have lived a long time, so it’s hard to surprise me, but the voters in Santa Barbara on election day managed to do just that. They, in their infinite wisdom, voted for every single tax increase on the ballot.

Is it just me or are there others scratching their heads wondering for the love of God why voters would want to increase their living expenses while residing in one of the most expensive places in America.

Besides the inevitable school bond measures we see almost every election cycle, this time voters were also given the opportunity to increase their sales tax by one half of a percentage point. These are the same voters who incessantly complain about the exorbitant cost of housing, endless increases in our electricity and utility bills, the cost of gasoline, food, restaurant prices, and almost everything else in Santa Barbara, so what do they do?

They make almost everything on that list more expensive.

The people who thought this was a good idea should not kid themselves. This is going to cost them quite a bit of money. Every Amazon purchase, restaurant meal, and almost every other consumer good will be more expensive beginning in April of next year, the effective date of this tax increase. If you are thinking about buying a car, do it before April. I’m not sure who can afford a new car these days since the cost of it has gone up by 33% since the appearance of the pandemic in 2020. Today, the average cost of a new car is $48,000. Now it will be higher for people living in Santa Barbara.

If the voters for some reason believe we were undertaxed, they ought to think again. We already have one of the highest sales tax rates in the country, not to mention state income tax and, yes, property taxes. Many people believe that because of Proposition 13, California has lower property taxes than other states. But when the average assessed value of a home is four or five times higher in California than other areas of the United States, you can be sure we are paying more property taxes than they are.

Part of me understands why voters keep approving almost every school bond measure that comes down the pike. Unlike some of us who study these measures and know how corrupt the process is, most voters don’t have the time or the wherewithal to get into the weeds to understand what they are voting on. They think if a school district is asking for the money, they must need it. We all want great schools, so it almost seems unpatriotic to not vote for whatever school officials ask for. However, we also understand what it means to pay higher sales taxes, so that excuse cannot explain why they voted for the sales tax.

Padding Those Pensions on Your Dime

Maybe they think, like most progressives, the additional tax revenue will get them more services or better government in Santa Barbara. But I believe in the wisdom of PT Barnum who is quoted as having said, “There’s a sucker born every minute.” Excuse my French, but is there anyone alive who really believes we are going to get cleaner streets, better transportation services, enhanced public safety, or more responsive government from our city bureaucrats? If you do, I have a vintage bridge to sell you.

The dirty little secret is that most of these additional revenues will go to fund the explosive costs of Cadillac pensions for our public sector workers. The city has to pay double digit increases in their contributions to keep these defined benefit pension plans solvent. Since the revenue well has run dry in their budget, they were forced to look for other sources of revenue, hence the sales tax increase. Thus, it very understandable why anyone in the public sector would support the sales tax increase, but please help me understand why anyone in the private sector with a 401K, IRA, or no retirement plan at all would want to subsidize a worker in the public sector with a pension plan most of us would give their right arm for.

On Tuesday, Nov 5th, the voters around the country expressed their displeasure with the status quo in America. However, in our little paradise, the voters rejected what the rest of America was serving up and voted to go their own way. Despite this act of virtue signaling, which will masochistically come out of their own pockets, the voters in Santa Barbara have signaled once again they will not bend, even if it leaves them poorer.

I agree 100 percent with your commentary. I have concluded that there are two general classes of people in our community:

The Progressive Liberals, who have the financial ability to ignore these increases. These are made up of Trust Funders, Government workers, Professionals and College students.

The Working Class, who have no interest, time or understanding of the consequences of their choice to remain uninformed and apathetic.

We know that most of the children in our schools fail math. So apparently do the voters. Those who resent those who are successful think "taxing the rich to pay their fair share" is something they ought to vote for. Not realizing higher property taxes will raise their own rents, the cost of products and services. The higher sales tax will cause people to go out of town for big-ticket purchases, another insult to locally owned businesses struggling against online shopping. But the worst insult of all is funding for the failing City College that will be wasted on a new sports pavilion, when our climate provides the ability to exercise outdoors year-round.

None of us voted to create the Lower State Death Alley. No one was given a chance to agree to the street grid destroying limitations, diversions, entry blocking, trees in former parking spaces, bike lanes removing trees....... and who of us needed to beautify the State Street underpass or believed it would draw tourists up from the beach?

Who benefits?