If the U.S. government were a business, it would be in Chapter 13 Bankruptcy. The official U.S. National Debt is now over $35 trillion. This fiscal year’s official U.S. Federal Budget Deficit is now over $2 trillion (the U.S. government takes in $4.9 trillion in tax revenue and spends $6.9 trillion). While the U.S. unfunded liabilities (future liabilities like Social Security and Medicare) add up to over $219 trillion.

“Cuts in government spending must take place, or financial disaster awaits us all.”

I’ve been in the financial services business for over 41 years, and until recently, we never used the word “trillion.” Now, we hear the word all the time, especially when discussing aspects of the U.S. debt.

Politicians don’t want to talk about our debt. Cutting costs is not good for political reelection campaigns. Cuts in government spending must take place, or financial disaster awaits us all. It’s not a matter of opinion, it is simple math. We need leadership with the courage to do the right thing.

This begins with a balanced budget.

We are seeing this “fiscal irresponsibility” at all levels of government. California’s state and local government debt is roughly $1.6 trillion.

Santa Barbara has serious fiscal concerns. The city’s spending is out of hand and is getting worse. Read the language carefully in Measure I on the current ballot. It looks as though this tax increase will be spent on basically everything the city is already supposed to provide. That is too simple a rationale for why Santa Barbara must raise taxes.

The increase called for by Measure I would take Santa Barbara’s sales tax rate to 9.25%, compared to Goleta and Santa Maria at 8.75%, and Ventura at 7.75%. Costs have indeed increased, but why can’t Santa Barbara make do like other Central Coast cities without seeking the highest sales tax in the region? It should not be about raising more tax revenue; it should be about fiscal responsibility.

Santa Barbara hasn’t demonstrated that cuts have already been made and that this tax increase is warranted. In fact, no other city in Santa Barbara County has a sales tax increase proposal on the ballot.

And consider the contrast between Santa Barbara and Santa Maria:

Santa Maria is larger by 20,000 citizens, but its budget is $346 million vs $577 million for Santa Barbara. Santa Maria’s annual salaries and benefits are $81 million vs Santa Barbara’s $152 million. How can Santa Maria operate a larger city with so much less money?

Vote against raising Santa Barbara’s sales tax yet again

Vote “NO” on all sales tax increases, including Measure I ( City of Santa Barbara)

It’s common knowledge that the most regressive tax is the sales tax. It disproportionately hits the poor and middle class the hardest. This is an equity issue. In these trying times our less fortunate should not have to pay more at the gas pump or the store.

Already Santa Barbara is world renowned as one of the most expensive places to live in America. Increasing the sales tax at this time would be a hard hit for working Santa Barbarians.

Santa Barbara leadership must learn to “live within its means,” to cut “fat” – and there is plenty of it – out of the budget before even thinking abou raising taxes.

We can begin to insist upon fiscal responsibility at the local level by voting “NO” on Measure I and by electing leadership with the courage to cut needless spending. It is equally important to do the same on the State and Federal level… before it’s too late.

And remember how important it is to stay the course!

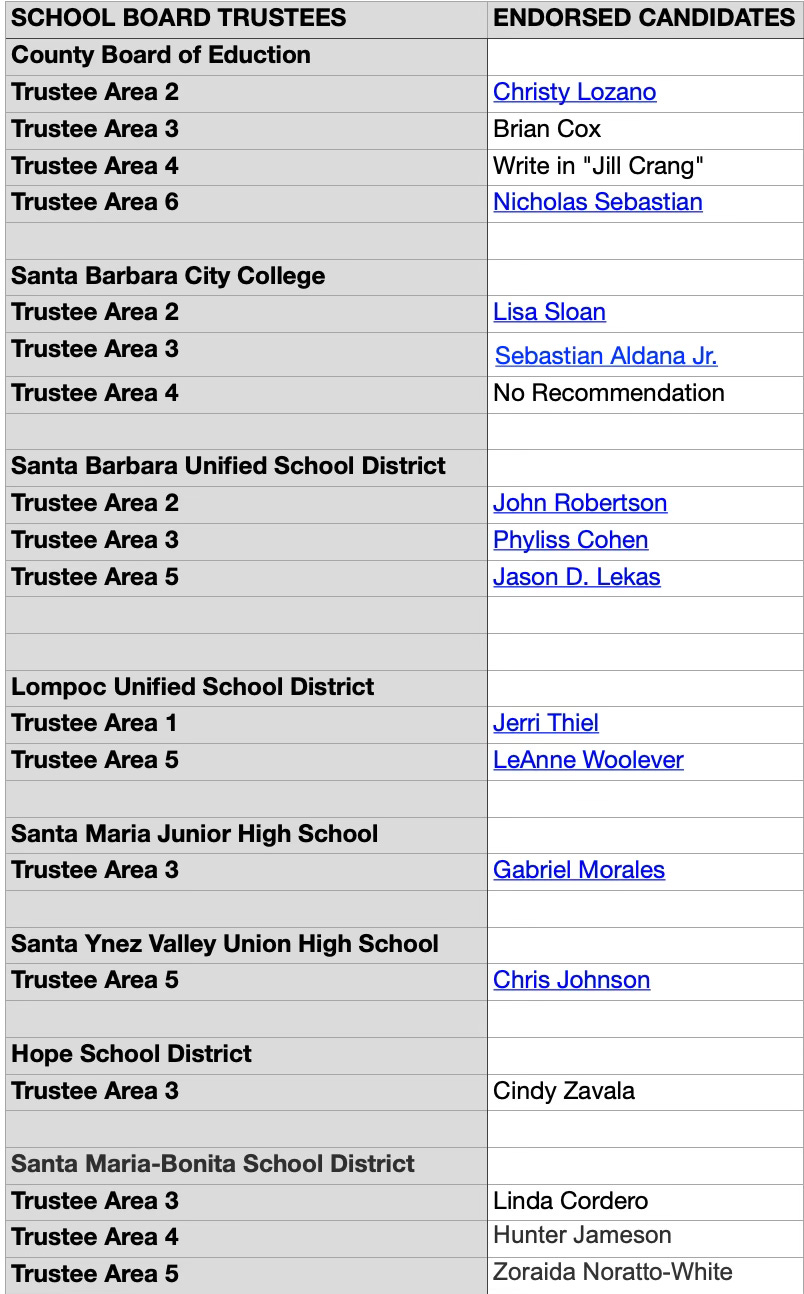

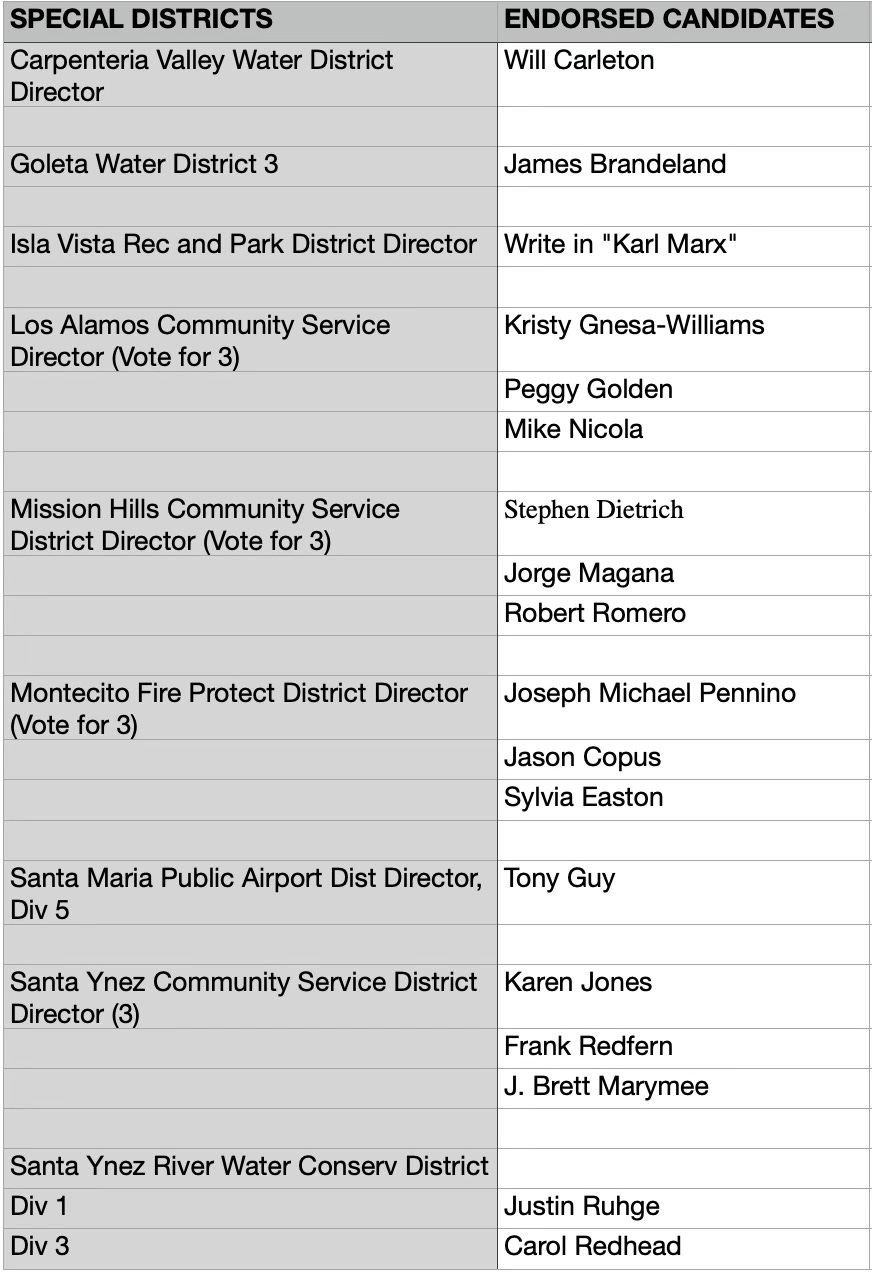

Santa Barbara Current’s Endorsement List (Nov 5, 2024 Election)

Giving government more money is the same as giving an alcoholic another drink or giving Hunter more cocaine. It is wasted and totally corrupting. Letting them borrow more money to pursue their pipe dreams is the definition of insanity.

This comes at a time where I just paid my first property tax payment for nearly $10,000, for something that I own. I’m voting no on all the proposed tax increases. It has to stop.