Vote NO on Measure I

Recently, we discussed Measure I and expressed our concerns regarding the City's strong advocacy for it. The City argues that it can no longer sustain Neighborhood Fire Stations, maintain Emergency Services, or ensure the safety and accessibility of our Parks. Additionally, they highlight issues related to homelessness and housing, among other pressing matters.

However, one must consider the implications of increased housing. More housing could necessitate additional emergency services, and if these properties are allocated to the Housing Authority and non-profits, it will lead to a reduction in property tax revenue from those areas. Furthermore, the demand for more housing could also result in the need for additional schools and parks, as well as enhanced infrastructure, such as sewer lines, to accommodate the growing population.

Given the current financial challenges Santa Barbara faces, it is prudent to pause and reassess our priorities. Just six years ago, residents were asked to support an increase in taxes through Measure C, and now there is a call for further financial contributions. The funds from Measure I would enter the general fund, which could be allocated to various expenses, including pension obligations.

Therefore, it is advisable to vote against Measure I.

Moving on to Measure P for SBCC

This column previously raised a question regarding robots at SBCC. I inquired about the reason behind benching all out-of-state football players during a game about a month ago. I learned that this was due to them paying in-state tuition instead of out-of-state rates. This raises questions about how this situation arose and how long it has been occurring, which could indicate a financial loss. Despite being our community college, some claim that only 40% of the students are from the local area.

Nextdoor had some good posts. Don Miller posted the following California Commentary written by Jon Coupal:

“Homeowners should read their tax bill before voting

“This past week, most California homeowners received the two most important pieces of mail they are likely to get all year. These are your property tax bill and your mailed ballot for the 2024 general election. While both deserve individual attention, let me suggest that you open them on the same day to put both in context.

“When reviewing your tax bill, the best place to start is to pull out last year’s bill and make a side-by-side comparison. Typically, your tax bill will show three categories of charges: the General Tax Levy, Voted Indebtedness, and Direct Charges and Special Assessments.

“Let’s break these down a bit.

“The General Tax Levy is what most people think of when talking about property taxes. This amount is based on the assessed value of land, improvements, and fixtures. It usually makes up the largest portion of the tax bill and it is the amount that is limited by Proposition 13. The annual increase in the General Levy of Assessment should be no more than two percent, unless there have been improvements to the property, like adding a room to the house.

“The second category of charges is Voted Indebtedness. These charges reflect the repayment cost of bonds approved by the voters. Local general obligation bonds for libraries, parks, police and fire facilities and other capital improvements are repaid exclusively by property owners. Because a minority of the population is required to pay the entire amount, the California Constitution of 1879 established a two-thirds voter approval requirement for these bonds.

“Until the year 2000, local school bonds also required a two-thirds vote, but the passage of Proposition 39 lowered the vote requirement to 55 percent. Because it is easier to pass school bonds, many homeowners are seeing a significant increase in the Voted Indebtedness column on their tax bills.

“The third type of levy found on the typical property tax bill is for Direct Assessments. These include so-called “parcel taxes” which are taxes on property ownership but are not imposed as a percentage of taxable value. Although there is no upper limit on the amount of parcel taxes you must pay, they remain – for now – subject to Proposition 13’s two-thirds vote requirement. Other direct levies may include charges for services related to property such as street lighting, regional sanitation, flood control, etc. Most of these are restricted by Prop. 218, the “Right to Vote on Taxes Act,” an initiative sponsored by the Howard Jarvis Taxpayers Association and approved by voters in 1996.

“It is obvious from the above that homeowners are heavily taxed for the “privilege” of owning property. But there’s more. Our highest-in-the-nation income tax rate, state sales tax rate and gas tax makes California one of the most heavily taxed states in the union.

“Now, knowing the above, open your mailed election ballot. Statewide, voters are being asked to approve more than 400 local tax and bond measures. On top of that, Propositions 2 and 4 are statewide bond measures each seeking $10 billion in additional indebtedness.

“Even worse, Proposition 5 would repeal the two-thirds vote for local bonds that has been an important homeowner protection since 1879. This opens the floodgates for higher property taxes as even the California Legislative Analyst predicts that passage of Prop 5 will lead to billions of dollars of additional tax burdens.

“It is undeniable that your election ballot and your property tax bill are inextricably connected. One asks for more of your hard-earned dollars while the other reflects how much you are already paying. The question that bears repeating is what have our politicians and bureaucrats done to prove that they need more?”

Another post on Nextdoor suggests we change the school bond process. Those that vote YES can add the cost to their property tax bill. Those that vote NO don’t. That way if you’re okay with the additional cost, you get them, but won’t force them on those of us that choose NO.

Todd B Writes

Property Tax bills are in the mail. Look at all added costs to what your regular property tax bill should be: school bonds, there are 8 bonds (Elem, HS, SBCC) mosquito-vector (really?), wildfire, flood! Stop voting to increase your taxes. My bill is over $600 more from these add ons! And if you rent, you don't escape from these taxes... it's called a rent increase.

Vote NO on Measure P. Vote NO on Measure I 2024...sales tax increase.

Please Read the Minutes

This is a must read. Minutes from SBCC Board meeting.

Board meeting highlights scheduling concerns and student tech access

“We need more solutions to student scheduling needs because of the downsizing of the schedule,” Ramirez said. “Our academic counselors are running out of courses to which to refer students.”

The downsizing of class scheduling refers to the number of course offerings being cut from the student schedule for various reasons. Due to this, counselors are being forced to refer students to take courses out of district to fulfill degree course requirements.

California Virtual Campus is an online educational initiative that allows California community college students to take online courses at other eligible colleges, without having to fill out a separate application, and it maintains a students’ affiliation with City College no matter where one may take a course.

“Counselors are doing their due diligence and sometimes making the very difficult choices to refer students to courses out of district,” Ramirez said.

VOTE NO ON MEASURE P

One More Email from a Reader

This from LT online regarding my last column:

Great work as usual Bonnie, very informative. Sounds like the city is drowning in red ink. The city deficit is one thing, but when you add unfunded pension liabilities of the county of $1billion and the state $1trillion, it adds an extra sense of urgency. Also, adding sales tax is again one thing, but the issue of repealing Prop 13 is of even more concern and if some activists have their way, will become reality.

If Prop 13 is ever repealed, it’s game over for California and will be the final nail in the coffin. I fear the pension doomsday scenario is just beginning and is a ticking time bomb waiting to go off on the taxpayers.

The root cause?

I think we all know; it’s been from years of mismanagement by the one-party state at managing costs, and colluding with the public sector unions. Both resulting in unrealistic city wages and pensions. When a city pension is more than what the employee would normally make, or more than $200,000 to $300,000 annually, you know you’re in trouble. Further, when negotiations happen between the unions and city government, both parties are seemingly to be on the same side of the bargaining table… surprise!

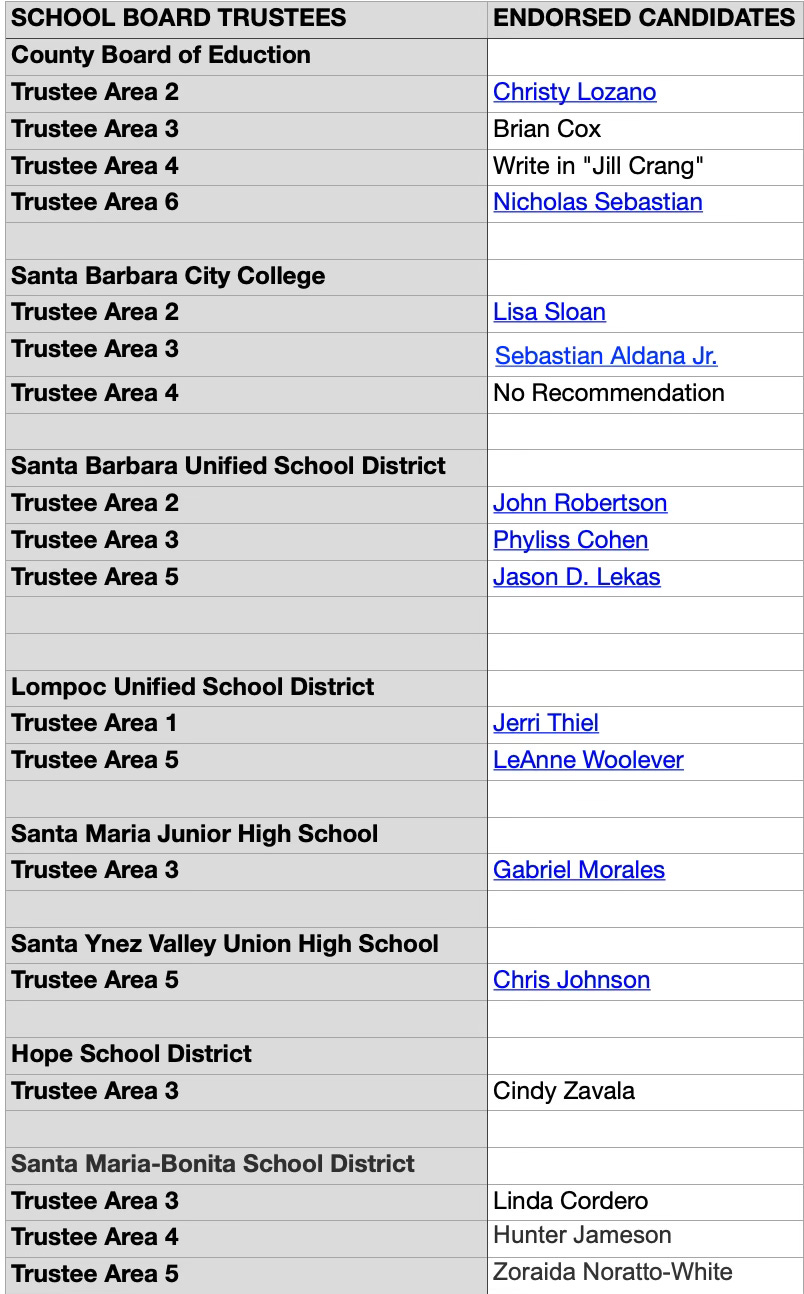

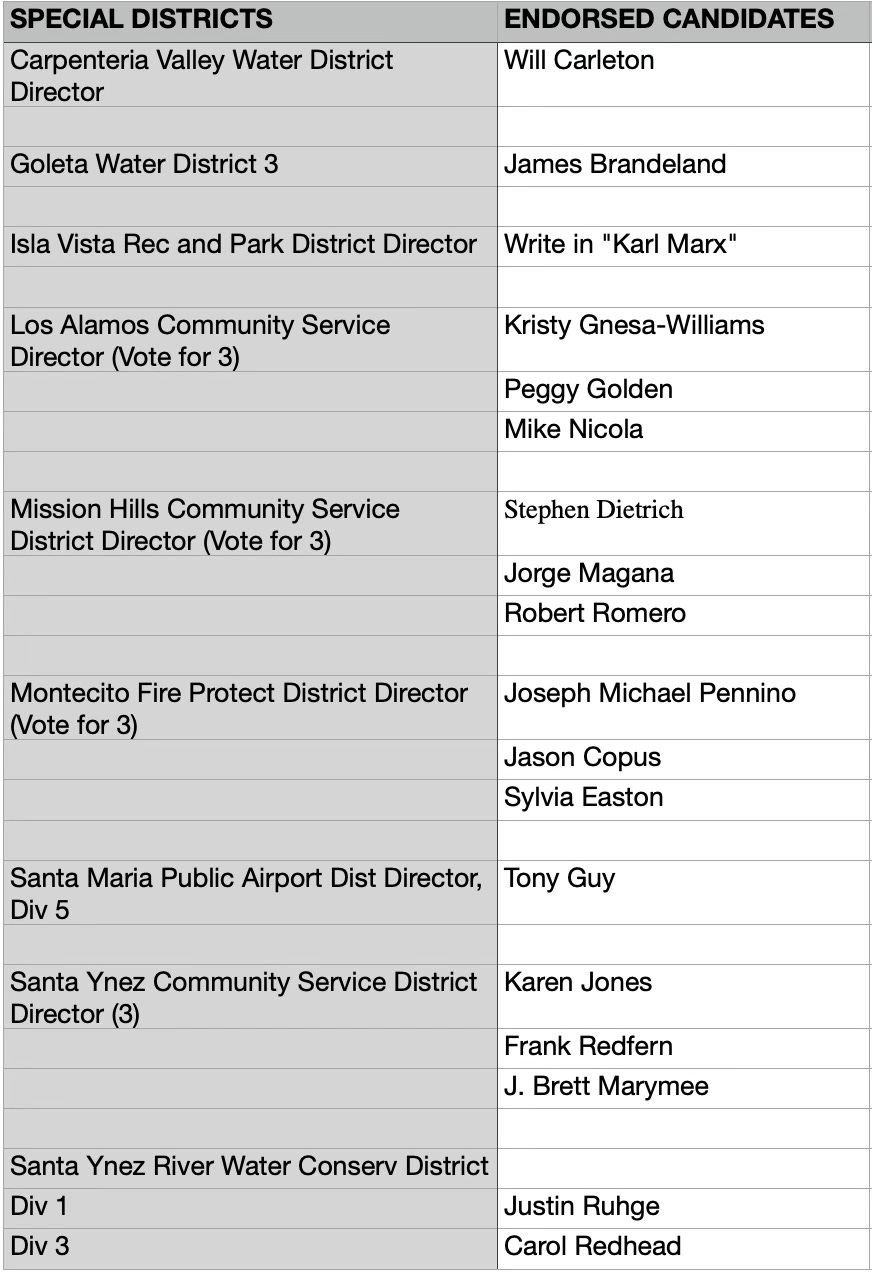

Santa Barbara Current’s Endorsement List (Nov 5, 2024 Election)

Property owners have an opportunity to directly inspect these occult additions to their property tax bill, but renters are usually unaware of the financial impact to their wallets. The increased costs to landlords are passed on to renters via increased rental rates. I appreciate the Current encouraging voters to read the tax statement before voting. So often the payment is included in the mortgage payment so property owners don’t take the time to scrutinize the bill.

It's come down now to national government warfare against its citizens vs local government warfare against its citizens. Ever wonder what you did to make your government hate you?

National warfare against us: Our army, which used to be there to protect us is now licensed under Department of Defense directive 5240.01, which means it can use lethal means on us citizens. But only if Democrats lose the election. Oh wait - they already have.

Local warfare against us: Our property taxes, which used to be there so our city of Santa Barbara could be kept up for our benefit is trying to license itself to raid our bank accounts solely for the benefit of its employees.

The difference between our national and local horror show is our vote can still save us locally. It remains to be seen in the coming weeks if that will be true nationally.

So: Vote no against all tax increases! Vote the Democrats out!

And I will always be grateful to Bonnie for all she has done and continues to do for this city.