Having seen my share of U.S. college graduates over the years as a financial consultant, I can report that the level of financial literacy among college students is, in a word, abysmal.

In a recent survey, conducted in September 2023 by EVERFI (a company whose mission is “to develop financial literacy and teach high school students basic money management and financial planning skills”), out of over 30,000 college graduates from more than 440 schools across the country, only 53% said they felt prepared to manage their money and finances. This puts young people at a severe disadvantage as they begin their careers.

Young people are not equipped to handle their finances for many reasons. Parents, for example, have taken financial responsibilities out of the hands of their children. “Helicopter parenting” (a style of parenting in which parents are overly focused on their children), has become more prevalent. These types of parents typically take too much responsibility for their children’s experiences and, specifically, their successes or failures, leaving them ill-equipped to take care of their own financial responsibilities.

I was fortunate to learn a lot about budgeting, profit, loss, and finances early on. While in grade school I had my own businesses; I was a paperboy for the Santa Barbara News-Press, I had gardening jobs and worked as a box boy at Safeway. While attending Bishop Diego High School, I was elected ASB Treasurer where I “cut a deal” with Herb Petersen, the owner of McDonald’s on Upper State, to bring Big Macs and milk shakes daily to the school. I ran that lunch program throughout my senior year. Those educational work experiences were invaluable to me later in life.

It is important to give young people financial education and responsibility early on.

As new college graduates, they may now be launching into their first serious job, bringing with it a first real paycheck. Figuring out what to do with that money can be overwhelming.

Fortunately, they have the greatest financial advantage of all on their side: time.

Financial literacy includes paying off debt, creating a budget, and understanding the difference between various financial instruments. All of which has a material impact when attempting to balance a budget, buy a home, fund your children’s education, and ensure an income for retirement.

Budgeting is important, so advise your children and/or grandchildren to make a commitment to do so right away. Let them know that once they have determined precisely where their money is going, they can confidently manage their expenditures. Personal finance is 20% knowledge and 80% behavior. Track spending; put together a plan to pay off debt. Their aim should be to spend less than they make.

Never Too Late to Begin

I am often asked when the best time is to start a retirement plan. It reminds me of the question, “When is the best time to plant an oak tree?”

The best time is now.

The following are five solid suggestions you should pass on to your offspring or theirs:

If you are not contributing to a retirement plan, you are giving money to Uncle Sam that you could keep for your retirement. Contribute as much as you can to your retirement fund now, before significant expenses such as buying a house and raising children come into play. Indeed, make sure you reach your employer match, if you have one (typically 3-6%), since it’s free money.

Establish an investment portfolio, in addition to your retirement plan. Start small, perhaps with a no-load mutual fund. Be consistent in contributing to this investment account on a regular basis.

Build your credit. Good credit is the key that unlocks many doors to financial success. A high credit score will help you get the best rates on loans, insurance, and a mortgage. Many employers and landlords also check credit scores when making employment and or tenancy decisions for due diligence. Now is the time to begin building your credit. In terms of debt, tackle all high-interest balances first.

Establish an emergency fund. Set aside three to six months’ worth of living expenses. While you may never need it, having this cushion in place just in case you become injured, ill, or lose your job, is great for peace of mind. Have those funds in a money market mutual fund or a high-yield savings account ensuring your liquid money is working as hard as possible.

Amid all these responsible behaviors, don’t forget to have fun. Put aside a portion of your money each month to save/invest (20% or so), and then spend some guilt-free money on adventures, eat delicious food, go to that concert, or take that trip you’ve wanted to take. You’ve done well. Now is your time to enjoy.

And above all, stay the course!

Boy Scout merit badge

Financial Management

Does all this.

Check out requirements on line.

I’m assistant scoutmaster & merit badge counselor here in HB City.

50% credit card holders don’t pay off card every month so at least 50% of parents are clueless!!!

David Ramsey is a good place for young people to start, although no credit cards are untenable in modern society.

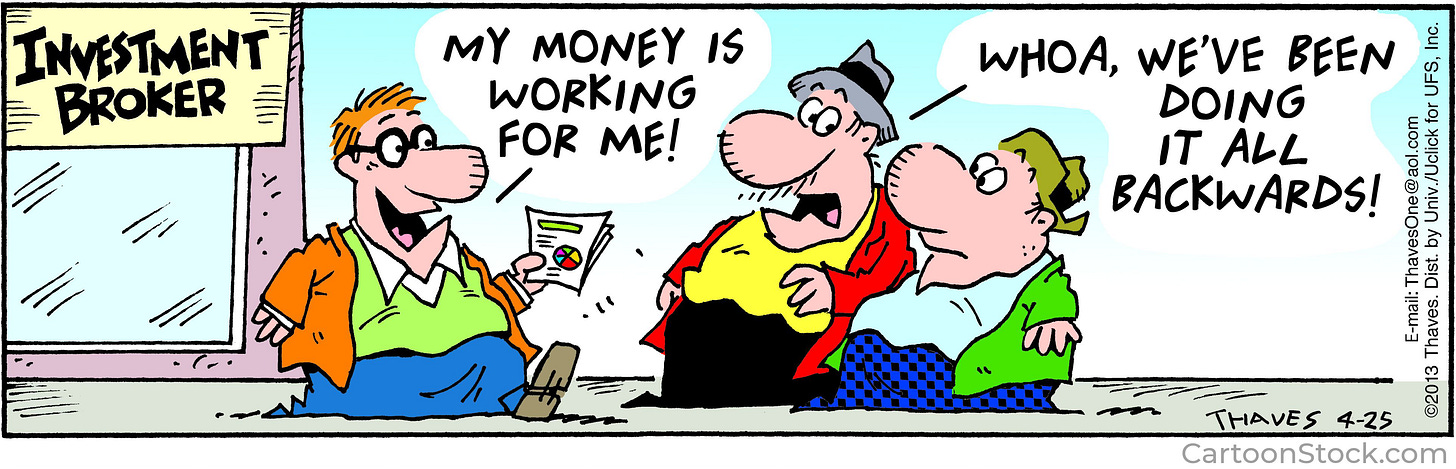

It took me 5 minutes to understand your comic strip.

Too sophisticated.

Money Work’n for me

Instead of

Me Work’n for my money.

My early life experience in this regard mirrors that of J. Livingston.

Also of the depression era, my parents taught me the essentials of managing money. At the age of 14, I was a paper boy. At the age of 15, I also got my first full-time job. I was very proud when I gave my mother 10 shillings towards the expenses of the household.

From those early days, I learned the wisdom of saving money and avoiding "The Never-never" to make purchases. Being poor is a great incentive to become financially self-sufficient.