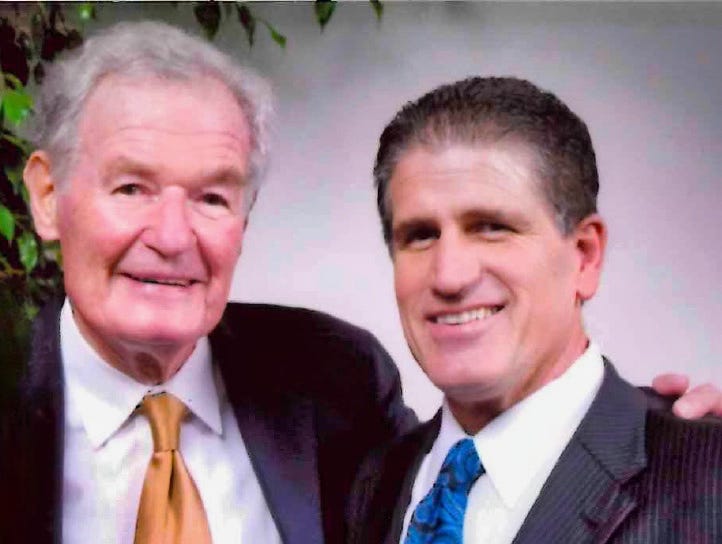

Larry Crandell, the one and only “Mr. Santa Barbara,” was one of Santa Barbara’s most important citizens for over four decades. This, simply because of his desire to give. Over the years, he helped raise more than $250 million for hundreds of great causes as Santa Barbara’s “preeminent emcee.”

Larry was my mentor as I began my career in financial services in 1983. He gave me great advice and one of the most important "gems" he left me with was just how important charitable giving is for everyone involved. He emphasized how many wonderful charities there are out there that are striving to make the world a better place in so many ways. Helping the charities will help you with a very valuable tax deduction. And, in addition to that, he told me and many others, “You will receive priceless psychic income. Your efforts will come back to you ten-fold in ways you can only imagine.”

Larry Crandell was born on April 5, 1923, in Lynn, Massachusetts and passed away in Santa Barbara in 2016. He grew up poor and virtually fatherless during the Great Depression.

He was just 19 in 1943 when, like so many of the "Greatest Generation," he answered the call of duty and volunteered to serve in the Army Air Corp in World War II. Larry was a bombardier on a B-24 Liberator in Europe. He narrowly escaped with his life when his plane was shot down and ditched in the Adriatic Sea after a bombing mission. He was awarded the Purple Heart for his service.

Larry Crandell rose to early success with Arthur Murray's ballroom dance business in the 1950s. He later became successful in his real estate investments and then found his true calling as a community leader and emcee in Santa Barbara. He was without peers in this area’s “charity world.” He was playfully serious and seriously playful and parlayed his tremendous ability to use humor to inspire people and “turn good fun into fun for good.” Larry amazed all with his quick wit, humor, and especially his desire to help.

I was with him at an event with over 300 in attendance where Larry helped raise over $500,000 for a charity. The next morning, I went to breakfast with him, and he noticed a distraught woman at a table nearby. Larry paid for her meal without her knowing and told the waitress, “Tell her an admirer paid the bill and that things will get better." Larry Crandell's life was filled with "giving." What a tremendous example he was to me and to so many.

His legacy lives on in Santa Barbara.

Charitable Remainder Trusts

Once the decision is made to give, it is important to decide how to give. You can "give" as a volunteer to a cause that is very important to you. Often a cash donation is the best method where a tax deduction is a benefit.

In other instances, it is important that you choose the most efficient and effective vehicle in which to give. In the realm of philanthropy and estate planning, the Charitable Remainder Trust offers a unique opportunity to make a lasting impact while ensuring financial security for donors and their loved ones.

A Charitable Remainder Trust is a legal arrangement where assets are transferred into an irrevocable trust. The income generated from those assets is paid to the donor or designated beneficiaries for a specified period or for life. It is a powerful estate planning tool that allows individuals to donate assets to a charitable organization, receive tax benefits, and generate income. After the trust terminates, the remaining assets are donated to a charitable organization or foundation of the donor's choice. CRTs provide a "win-win" situation by combining philanthropy with financial planning. Many charitable organizations will cover the costs of setting up the trust and the planning process.

Tax benefits are a significant part of a Charitable Remainder Trust. When assets are transferred into the CRT, the donor can receive an immediate tax deduction based on the present value of the trust interest. By donating appreciated assets, such as common stock or real estate, donors can also avoid capital gain tax on the appreciation.

The Charitable Remainder Trust assets are invested, and the income generated is paid out to the donor or beneficiaries as regular income. This can be especially beneficial for individuals who rely on the income from their assets to cover living expenses. The payments can be structured as either a fixed amount (Annuity Trust) or a percentage of the trust's value (Unit Trust).

Charitable Remainder Trusts enable individuals to support charitable causes close to their heart. By designating a charitable organization or foundation as the ultimate beneficiary of the trust, donors can leave a lasting legacy while supporting the causes they care about.

CRTs are a tremendous way to contribute to a positive change in society.

Establishing a CRT requires careful planning and consideration. Donors need to assess their financial situation, long-term goals, and the potential impact on their estate. Professional advice from estate planning attorneys, financial advisors and tax experts is crucial to ensure the trust is set up correctly and aligns with the donor's intentions.

A Charitable Remainder Trust provides the donor with tax deductions, income for life, as well as helping a great cause the donor is passionate about. However, the most important benefit very well could be, as Mr. Santa Barbara, Larry Crandell often said, “the priceless psychic income one can receive from giving.”

Remember to give of your time, talent, and treasure, and above all, to stay the course!

I read this article by Mr. Tremblay and I quote "Charitable Remainder Trusts enable individuals to support charitable causes close to their heart. By designating a charitable organization or foundation as the ultimate beneficiary of the trust, donors can leave a lasting legacy while supporting the causes they care about."

There is another deeper and darker side to "Charitable Remainder Trusts" that they can be and are used to conceal and direct money to those in kick backs and pay backs. Charitable Trusts are not well scrutinized by the IRS. With a large number of "Charitable Trusts" in Santa Barbara with the Good Ole Boys and Good Ole Gals this financial vehicle can easily be used to pay back your benefactors.

I would advise all here to look at this Video and Money Laundering into Charities.................

https://www.youtube.com/watch?v=64ybpYdZwiA

Howard Walther, member of a military family

Ah yes! Mr Crandell, or Mr Santa Barbara was a “coining” for this Champion for so many, especially the Nonprofit World! I was incredibly fortunate to be able to call Larry my friend. His quickness of wit with humor was a trademark. I would compare him with Bob Hope. Where Larry shined brightly was as MC for a charity kindly embarrassing individuals for their donations. Larry understood the immense importance of the Nonprofit world filling in the many gaps society creates.